Recently saw pictures on BK gem show which was basically a ghost town - people obviously were no-shows because of the perceived risk from the virus. But what are likely to be the broader effects from a pandemic (as this is very likely soon to be) on the gem markets? Clearly the financial markets are in a major correction and this has the potential to set off a economic recession of duration unknown. Anyone remember the 2008/2009 period and the short term effects on gem pricing etc? I am noting prices on GRA auctions seem to be softer than a few weeks ago (personal observation). Any thoughts?

I’ve been selling gems part time since 1993 (when my dad gave me a briefcase of stones with my cost and said ‘go sell, you can keep all the profits’) and full time since 1999.

SARS in 2003 hit Toronto fairly hard, I had people cancelling orders from me because they didn’t want SARS coming to their door, that said, I think most people who were on solid ground financially did just fine.

My best guess is that this is a short term temporary hiccup, vaccines are already being developed and COVID-19 will be a vague memory soon enough.

THAT SAID: It may be a good time to try to get good deals from people who need money today, I know that I bought some GREAT material from some dealers from Hong Kong in Tucson because they knew that they were going back to a Ghost City and no Hong Kong fair.

Interesting comments, thanks. You mentioned the SARS issue (a good parallel) but how did you find the gem markets in Canada dealt with the 2008/9 crisis?

I rather think we are looking at a minimum 9-12 months disruption and the economic fall-out could be significant in some nations. General release of a proven vaccine will be a year away at best unfortunately.

I don’t think that the economic crash of 2008/2009 is a good comparison, banks aren’t going belly up and people aren’t being kicked out of their homes en masse.

Remember the old Wall Street adage, ‘Bulls make money, bears make money, sheep and hogs get slaughtered’

There is always money to be found, it’s just harder to find sometimes.

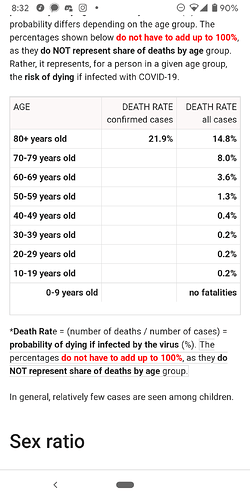

Also this, COVID-19 does not have much effect on healthy adults.

I have underlying lung issues, so I try to be extra careful, but this is not the end of the world.

The flu virus in 2018, in the USA resulted in an estimated 959,000 hospitalizations and 61,099 deaths. Around 1 in 16.

At the moment, going on the numbers today, globally, the corona virus has 92,818 confirmed cases and 3,160 deaths, about 1 in 29, it has a long way to go to catch up to the 2018 flu virus. You have to love media based panic.

But if it means I can get stones cheaper, I’ll not complain to much about it.

Thanks for the replies - I guess I asked about the 2008/9 crisis on the basis of what we might get too. Many business analysts are already calling recessions for Japan, Korea, various of the European nations, - and the China slump has been prodigious. What is initially a health emergency may rapidly transmit to an economic crisis (the Federal Reserve in the US clearly thought there was a big issue today with an emergency 0.5% rate cut - which was then greeted with a 800 points fall in the Dow). Globally central banks don’t have much ammunition left (interest rates are already very low) and corporate and private debt levels are very high. It is not drawing such a long bow to suggest we get to a bad economic situation rather quickly. As for the disease itself - spread in the US is only just starting, so drawing a parallel between the situation now and what happens over an entire flu season is not really a valid comparison. We do know that COVID-19 has a similar Rnought (rate of transmission) to seasonal influenza but that it’s mortality rate is about 20 times higher. So just re-assess those flu figures - same rate of transmission + 20 times mortality means not 60,000 excess US deaths in a year, but 1.2 million. I am not sure either the US health care system or the US consumer would thrive under those parameters.

While I admit that the worst case scenario is POSSIBLE, I don’t think that it’s probable.

If you are really nervous about the near future, you may want to step back for a while and sell out of your inventory.

I think that the DOW is probably going to lose another 10k points, but that just puts us back to early 2016, and probably a more realistic value.

Gold will probably hit 2k USD and stay there.

Fine gems will continue to be in demand, I think that we will see some positive effects on the gem market with people deciding to invest more money into things that they can hold and put in their pockets if they need to leave their current areas.

There is good and bad in everything, it’s your job to find the opportunities.

Also, my wife is a nurse and shared this, so I figured I’d pass it along!

Just a reminder, please keep all comments focused on the topic of the coronavirus’s effect on gem markets.

This outbreak is going to effect all levels of the jewelry industry. With major shows being canceled, small wholesalers will feel the pains first. Retailers will be next, as customer traffic slows (both fears of financial uncertainty and actual fear of the virus). Lastly will be the larger wholesalers for both finished goods and materials, since the retailers aren’t buying. I dont think this particular virus is much worse than the typical flu. It is highly contagious, however. Not to mention that the media fear mongering creates more panic.

Regardless of the specifics, it’s going to put a dent in everyone’s business.

I agree with Skyjems.

I will add that (as far as the United States is concerned) the consumer here is doing fine … well employed and plenty of spending money. The decision I have is what to use my extra money to invest in.

Stocks were too high and set for a correction (but now seem attractive), bond rates are too low, gold is looking good. As far as gems, I just started learning about gems this year and I think if you do your research then they make a great investment.

So my thought is as long as people have jobs and the stock market is swinging up and down too much for people to want to invest, then I see the gem market and gold doing well.

Now if this causes a recession and unemployment spikes, then you will see a pull back in all spending.

Curious if anyone else had a show this past weekend?

Definitely VERY slow here in Toronto, which was expected. I got calls/texts from several customers who I had invited that they wouldn’t be able to make it out, a couple of whom are always slam dunks, so that hurt.

A couple of people were here from Bangkok and Sri Lanka, I felt pretty badly for them because there is NO WAY they could have made their expenses.

That said, coloured gemstone prices generally move much more slowly than a lot of other assets, I lowball offered on a few stones and people definitely weren’t willing to take a hit YET.

I still believe that this is a temporary hiccup because all of the REAL data is quite positive.

I am afraid the REAL date won’t be staying positive very long. The collapse in the oil price is potentially going to set off a nasty train of events (there is enormous corporate debt, particularly in the US shale patch, in that market).

Plus the virus is starting to move in the US - I doubt their health care system will cope well (their initial testing program was hopeless).

I think we are looking at a major economic event now, with secondary effects (watch the corporate debt situation). As for it’s duration? Unknown. We suspended buying stock (except for orders) 2 weeks ago.

My opinion is it will become more of a buyers market until this turns around. Pretty much anyone with cash or a good barter is king, so things are a bit softer but I don’t think thats going to last long. Most good gems will simply be put on hold unless the Seller is in trouble financially. Even then I’ve seen people give up there home over giving up a one of a kind gemstone they have. I think with the anticipation that once Things get good again the stones can sell for enough to replace what is lost . I don’t see Colored gemstones dropping too much ever. Theres only so many of certain source localities. However Diamonds are a controlled market and quite guarded against times like these… Same goes for them. It all depends on the financial shape of the seller. Desperate people do desperate things like sell stones for what ever they can get for them is it means feeding their family or keeping their car or home. I saw it during 9/11.

Food For thought.

Well we are about a month in from where I made my original comment. I think it’s safe to say that the economic impact is now going to be huge - witness the massive jumps in US unemployment, the collapse in PMI data from Europe and plenty more negative data. I doubt very much this will be a V shaped recovery either, so the effects are likely to be prolonged. Many commentators are saying it’s 2008/9 on steroids and I see no reason to disagree with them. As to my original question as to effects on gem pricing etc? Well clearly both the gem trade and the jewellery industry are going to take a hammering. We have already noticed price reductions from some sellers we follow, though I suspect it’s early days on that front. However an added complication is the surge in the US$ - it’s moved +10% against our currency which makes buying gems more expensive from where we are. Our business has picked up only a handful of low value orders in the past 2 weeks, whereas previously we were at maximum capacity and placing people on an ever lengthening waiting list. We are going to be chewing through that waiting list fairly quickly. Bon chance everyone…

Well I believe it’s just like the stock market. It’s based more on emotional stability than reality. Is the glass had full or half empty. You must decide for yourself. I believe the glass is always half full!

There is a saying: ‘I create what I believe’, if everyone buys into this being the end of the industry and starts selling their goods for half their cost or cheaper, we will undoubtedly have a massive crash because WE WILL CREATE THAT CRASH!

Predicting the future is impossible, but there are a lot of things going for our industry, including the longest marketing campaigns in the world, with our gems mentioned in every holy book I know of! People have understood gems to be precious for tens of thousands of years and IIRC the oldest jewellery found in an archeological dig is currently at about 135,000 years old

Regarding the near future, this is a very interesting article to read:

Good luck all!

David

David - this was your comment back on March 4th:

‘‘My best guess is that this is a short term temporary hiccup, vaccines are already being developed and COVID-19 will be a vague memory soon enough.’’

I get that you are an optimistic sort of guy. But optimism can be as dangerous as pessimism, when equally misplaced. I have never subscribed to this idea of ‘talking ourselves into a recession’ - the latter are caused by external forces not by group-think.

We are in the most difficult times economically since WW2, and it would be wise to acknowledge that when making plans to get our businesses through the next 12 month. Substantially deflationary forces have now come into play and we will all have to deal with the consequences of them. In contrast I might add that as jewelers the gold price increasing is a factor we could have very much done without as it puts a significant input cost up at a time when consumers are under huge pressure. This is beginning to look like a perfect storm…

You are not the first person to tell me I am excessively optimistic. ![]()

I agree 100% that we are heading into the most difficult economic times since WW2/Pre-WW2.

There are going to be people dumping goods as soon as these lockdowns are lifted because they borrowed money from the bank or the ‘wrong people’. ![]()

Gold prices are crazy which sucks for manufacturing.

But there are positives in more or less every situation.

Some people dumping goods = availability of stock for good prices.

Gold prices high = offer silver for cheaper (which may increase your bottom line down the road)

People being laid off = big pool of talent to choose from for your business.

I’ve been doing this business since I was seven years old, and independantly under my own company since 1999. I plan on doing it at least another 50 years, or until I die, whichever comes first.

911 and the ‘tech bubble bursting’ are distant memories to me, in 2040 I plan to look back on COVID similarly ‘oh yeah, that was a thing, it sucked, but I learned a lot of lessons from it’

As for ‘thinking ourselves into a recession’, you are right, there are major external forces at work right now. However, runs on the bank are 100% a ‘groupthink’ problem.

If everyone went to get all their cash out of the bank on any day in the past 100 years, regardless of how good or bad the economy was, it would cause massive crash leading to an economic downturn at least as bad as COVID.

The coloured gem industy is quite small and I would guess could be crashed by as few as 500 medium to large sized dealers dumping their goods on the market.

There are several ‘trash men’ out there who buy all the closeouts for cheap, but they could never eat enough material to stabilize the market.

So although you are right that this recession we are in and going to be in for at least another quarter or two is caused by external forces, the coloured stone market won’t crash as long as cooler heads prevail.

ALL OF THIS SAID: Yes, 100% we are well into a hiccup, and I agree with you about temporary deflation.

Good luck Andy, I think we both sincerely hope that in five years from now you are coming back saying ‘Dave, you were right, I did XYZ in response to changes and I am making triple the profit that I made pre-COVID!’ ![]()

Blessings and best wishes of health and prosperity!

David Saad

I most certainly hope you are right David!